Anticipating an attractive Philippine stock market

By Mhicole A. Moral

The Philippines has become an attractive market for both local and foreign investors, demonstrating resilience in the face of economic obstacles. In 2024, the Philippine stock market is expected to offer a dynamic landscape of opportunities and challenges, which investors and market enthusiasts are eagerly anticipating.

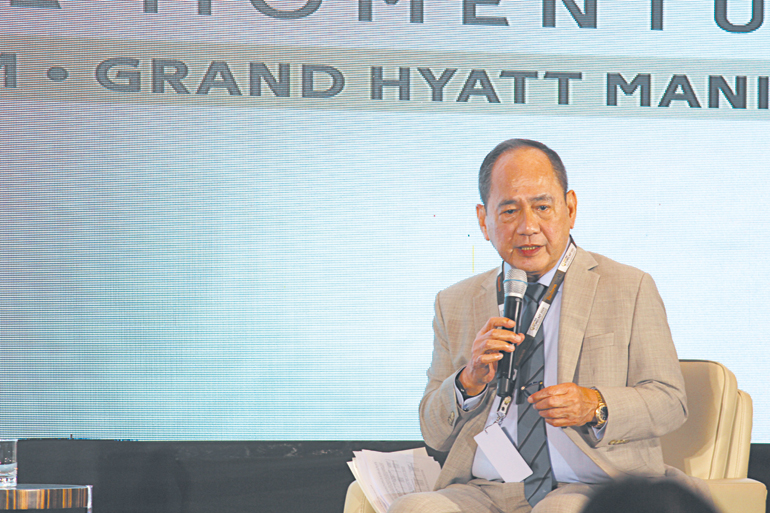

In a fireside chat themed “Dissecting the Stock and Bonds Market Outlook for 2024” during the BusinessWorld Forecast 2024 last Nov. 23, Ramon S. Monzon, president and chief executive officer of the Philippine Stock Exchange (PSE) shared about the performance of the stock market this year and his insights into what lies ahead for 2024.

Mr. Monzon acknowledged that 2023 brought disappointments in terms of the stock market’s performance, particularly in trading volume and the number of companies going public. Several companies that planned to go public in 2023 deferred their initial public offerings (IPOs) due to volatile market conditions.

However, he emphasized that this trend is not unique to the Philippine market but is observed across the Southeast Asian region.

Despite this, Mr. Monzon remains optimistic about the future of the Philippine stock market and highlighted several initiatives to enhance the market’s attractiveness and resilience.

“We at the PSE, we’re always optimists,” he shared. “Our job is to provide products, provide an efficient platform for people to trade and exchange, and harmonize the needs of companies that need to raise capital versus the equally important advocacy of PSE to protect small investors.”

He also acknowledged that while the IPO prices of real estate investment trusts (REITs) have experienced fluctuations, the appeal lies in their attractive yields. Therefore, the declining prices have resulted in higher yields, attracting investors who value steady income.

“In the PSE index, we have nine of these 30 giving dividend yields of more than 10%. I mean, you can’t get that up anywhere. And that’s for the third quarter. We expect the fourth earnings to be even higher,” Mr. Monzon explained.

Making the Philippine market more attractive

The Philippines has been seen as a promising market for local and international investors for quite some time. However, the market has become less attractive due to the recent economic challenges and the impact of the pandemic. As a result, the national government and financial authorities, especially the PSE, are working together to implement measures to make the Philippine market more appealing to local and foreign investors.

According to Mr. Monzon, current retail investors comprise around 19% to 20% of the average trading volume. The PSE president acknowledged the impact of high interest rates on the market. In addition, friction costs, including stock transaction taxes and fixed commission rates, have been a major challenge that puts the Philippines at a disadvantage compared to other markets in the ASEAN.

“In Jan. 2021, at the height of the pandemic, we were hitting about 12 billion in trading volume. The retail investors comprise [52%] of the trading volume,” he said. “So, in short, we know that the retail investors are there. What’s really hurting the market right now, I would say, is the high interest rates.”

“Only in the Philippines do you have a stock transaction tax of 60 basis points, 0.6 of 1%. We have a minimum broker’s commission rate of 0.25. So, if you do a round-trip transaction in the market, you buy, you sell, and you’re down 1.1% right away, 110 basis points. So, if you’re a foreign investor, you’re talking about earning 2%, 3%, or 4% in the market, 1.1 friction cost is very discouraging,” the PSE president added.

In turn, legislative efforts are underway to reduce the stock transaction tax and dividend tax for foreign investors, potentially acting as a significant game-changer.

“[There is] a bill that would reduce a stock transaction tax from 60 basis points to 10 basis points, and reducing the dividend tax for foreign investors from 25% to 10% again, to entice the foreign investors to come back and put our market at a level playing field,” Mr. Monzon noted.

“We’re hoping the Senate can do something about this before they do the recess. If not, it’s going to be in the first quarter, but that’s a very big [deal]. I think that could be a big game changer, the reduction of the friction cost,” he added.

In addition, the resistance level in the market, currently hovering between 62 and 65, was identified as a hurdle. Mr. Monzon emphasized the importance of interest rates in stimulating market activity. For instance, if interest rates go down or the expectation of such a decrease arises, the excess liquidity in savings and time could flow into the market. Conversely, rising interest rates could deter market participation.

Moreover, the PSE president announced their intention to introduce short selling in the Philippine market to attract institutional investors and boost market liquidity.

“We are pushing for the short selling product to entice foreign investors to return to the market because, without the short selling, the Philippine market is just a long market. If there is some bad news in the Philippine economy or even the Asian economy, and investors feel the need to get out of the market, in the Philippine market, they have no choice but to sell,” said Mr. Monzon.

“But with the short selling, they will now have the ability to hedge their portfolio and investments,” he continued. “So, they will not be selling, but they will just be doing some hedging.”

Addressing the issue of listings, Mr. Monzon shared the PSE’s commitment to fostering an environment conducive to the growth of small and medium enterprises (SMEs). Acknowledging the urgency for SMEs to secure funding for expansion, he highlighted the liberalization of listing rules.

According to the PSE president, they have reduced barriers to entry, allowing companies with a two-year operating history and a sales growth of at least 20% to qualify for listing, even without a profit track record.

To further facilitate SME listings, the PSE introduced the Listing Engagement and Assistance Program (LEAP). This initiative provides guidance to companies, particularly those facing challenges in preparing for an IPO.

Furthermore, Mr. Monzon affirmed that these changes were now the new listing rules. The adjustments, initially implemented to mitigate pandemic-induced economic challenges, have proven effective in encouraging more companies, especially SMEs, to consider going public.

In response to the trend of local companies listing abroad, particularly in Singapore, the PSE president emphasized the mutually beneficial nature of dual listings. Notably, companies listed in both the Philippine and foreign markets enhance market liquidity.

“If the DRs (depository receipts) of the local companies trade very well in the foreign markets, they will have to buy the corresponding shares here. So that will increase the liquidity here,” he explained.

On the topic of corporate earnings, Mr. Monzon expressed optimism, citing positive reports from major banks such as BDO, BPI, Metro Bank, China Bank, and PNB. These institutions have reported significant increases in earnings, with some boasting a remarkable 35% increase over the nine-month period.

“When you go to the 12-month, year-end, the earnings are really going to, I guess, go through the roof. If inflation goes down, then, obviously, these companies will have a lower cost of capital and a lower cost of borrowing — they can expand. So, you should expect the earnings to go even higher,” he added.

The PSE president also touched upon the time and effort involved in introducing innovative market mechanisms. For instance, obtaining regulatory approval for short selling took four years. Acknowledging the potential delays in crafting new rules, Mr. Monzon suggested collaborating with regulators by providing existing rules from other exchanges to expedite the approval process.

The conversation also touched on sectors that could drive capital market activity in the coming year. Mr. Monzon hinted at a potential listing of a mining company — an area the Philippine stock market has not explored for a considerable period. He emphasized the need for a new income stream for the Philippines, suggesting that responsible mining should be a valuable contributor.

“Mining does not equal to, I guess, environmental deterioration. There’s such a thing as responsible mining… I think the biggest obstacle for mining companies to operate is not so much the environmental impact but the LGU approval. So, if the national government can help these mining companies overcome the LGU challenges, I think we should be okay there,” said the PSE president.

Digitalization and inclusivity

Mr. Monzon shedding light on the positive impact of digitalizing trading for financial inclusivity.

For instance, fintech app GCash introduced GStock to make online trading services accessible to the public. The PSE has adjusted its board lot to allow retail investors to participate with a minimum investment of 100 pesos. The PSE president has stated that this move reflects a concerted effort to make the stock market more financially inclusive.

“Foreign investors know that institutional investors comprise a bigger share of any market. But when they see that a market has big retail participation, they get encouraged. So, we’re hopeful that we’ll take off.”

Meanwhile, the PSE has indicated a cautious approach to digital currencies, citing recent controversies, including the issue of money laundering by the founder of a crypto exchange giant. Instead, the PSE focuses on expanding the market’s product offerings, such as introducing DRs by next year and aiming for derivative trading by 2025, aligning the PSE with regional counterparts.

In closing, Mr. Monzon encourages investors to consider the historical outperformance of the stock market compared to bank deposits, particularly during times of high-interest rates.

“While the market is at this level, it would be very prudent for investors to start putting some of their funds in the market, and I think next year will be a much better year,” Mr. Monzon said.