Debt yields inch up amid profit taking

YIELDS on government securities (GS) rose slightly last week as the shortened trading period caused investors to pocket their gains and position before the year ended.

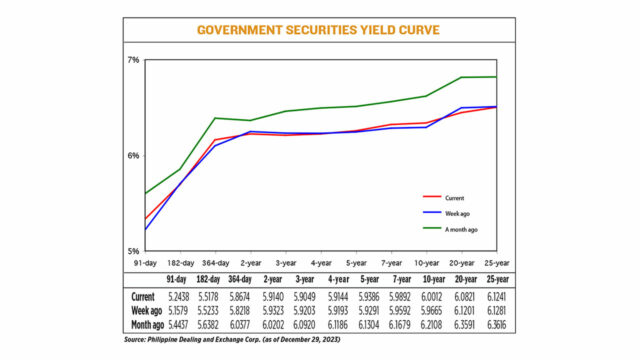

Rates, which move opposite to prices, went up by an average of 1.09 basis points (bps) week on week, based on PHP Bloomberg Valuation Service (BVAL) Reference Rates as of Dec. 29 published on the Philippine Dealing System’s website.

Yields at the short end of the curve mostly went up last week, with rates of the 91- and 364-day Treasury bills (T-bills) rising by 8.59 bps and 4.56 bps to 5.2438% and 5.8674%, respectively. Meanwhile, the 182-day T-bill fell by 0.55 bp to yield 5.5178%.

At the belly of the curve, yields on the two-, three-, and four-year Treasury bonds (T-bonds) declined by 1.83 bps (to 5.914%), 1.54 bps (5.9049%), and 0.49 bp (5.9144%), respectively. On the other hand, the rates of the five- and seven-year T-bonds rose by 0.95 bp (to 5.9386%) and 3 bps (to 5.9892%), respectively.

Rates of tenors at the long end mostly went down. Yields on the 20- and 25-year debt papers declined by 3.8 bps (to 6.0821%) and 0.4 bp (6.1241%), respectively. Meanwhile, the 10-year T-bond saw its rate rise by 3.47 bps to 6.0012%.

Total GS volume traded on Friday fell to P14.06 billion from P22.51 billion on Dec. 22.

Yields were mostly mixed last week as buying flow was met with sellers taking profits on earlier positions, Security Bank Corp. Chief Investment Officer for Trust and Asset Management Group Noel S. Reyes said in an e-mail.

“Such activity led to a quiet pause ahead of the new year and a new year auction,” Mr. Reyes said.

While the Bangko Sentral ng Pilipinas (BSP) has not signaled when it will pause, the US Federal Reserve’s easing hints led to “a sold rally of long-dated tenors for both the dollar and peso government bonds, flattening both curves,” he added.

BSP Governor Eli M. Remolona, Jr. last month said the central bank is unlikely to deliver any benchmark interest rate cuts in the next few months and is leaning towards keeping borrowing costs higher for longer.

The BSP will only begin policy easing if inflation settles within a “comfortable” range or the midpoint of its 2-4% target band, Mr. Remolona said.

The central bank raised borrowing costs by a total of 450 bps from May 2022 to October 2023, bringing the policy rate to a 16-year high of 6.5%.

The BSP has said inflation could settle within the 2-4% target in the first quarter of 2024 but could overshoot the target again from April to July partly due to the El Niño weather event.

In the first 11 months of 2023, headline inflation averaged 6.2%, still above the BSP’s 6% forecast and 2-4% target for the year.

Meanwhile, the Fed last month kept borrowing costs unchanged at 5.25-5.5% for the third straight time. This was after it hiked policy rates by 525 bps from March 2022 to July 2023.

Markets expect the US central bank to begin easing its policy stance as early as March, with investors penciling in cuts worth up to 150 bps this year.

On the other hand, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said, “the last trading week of 2023 [saw] PHP BVAL yields mixed [with] little change, after declining for most weeks since November.”

“Government yields declined broadly for the year as domestic inflation retreated from historic highs at the end of 2022,” a bond trader added in an e-mail.

Trading volume remained muted due to the holiday season and as investors look forward to policy rate cuts from the BSP and US central banks by 2024, the trader said.

GS yields will remain influenced by the BSP’s policy guidance and the Fed as market participants continue to expect policy easing in 2024, the bond trader added.

Mr. Reyes said that “since inflation started to trend lower, yields too have come off in anticipation of the BSP pause which till now is expected to occur anytime till March 2024.”

“[For the coming weeks,] we expect a positive run on both curves with yields coming off and steepening the slope,” he added. — A.C. Abestano