Remittance growth slows in February

CASH REMITTANCES from overseas Filipino workers (OFWs) increased in February, although at its slowest pace in 13 months, reflecting the impact of the resurgence of coronavirus disease 2019 (COVID-19) infections in many countries.

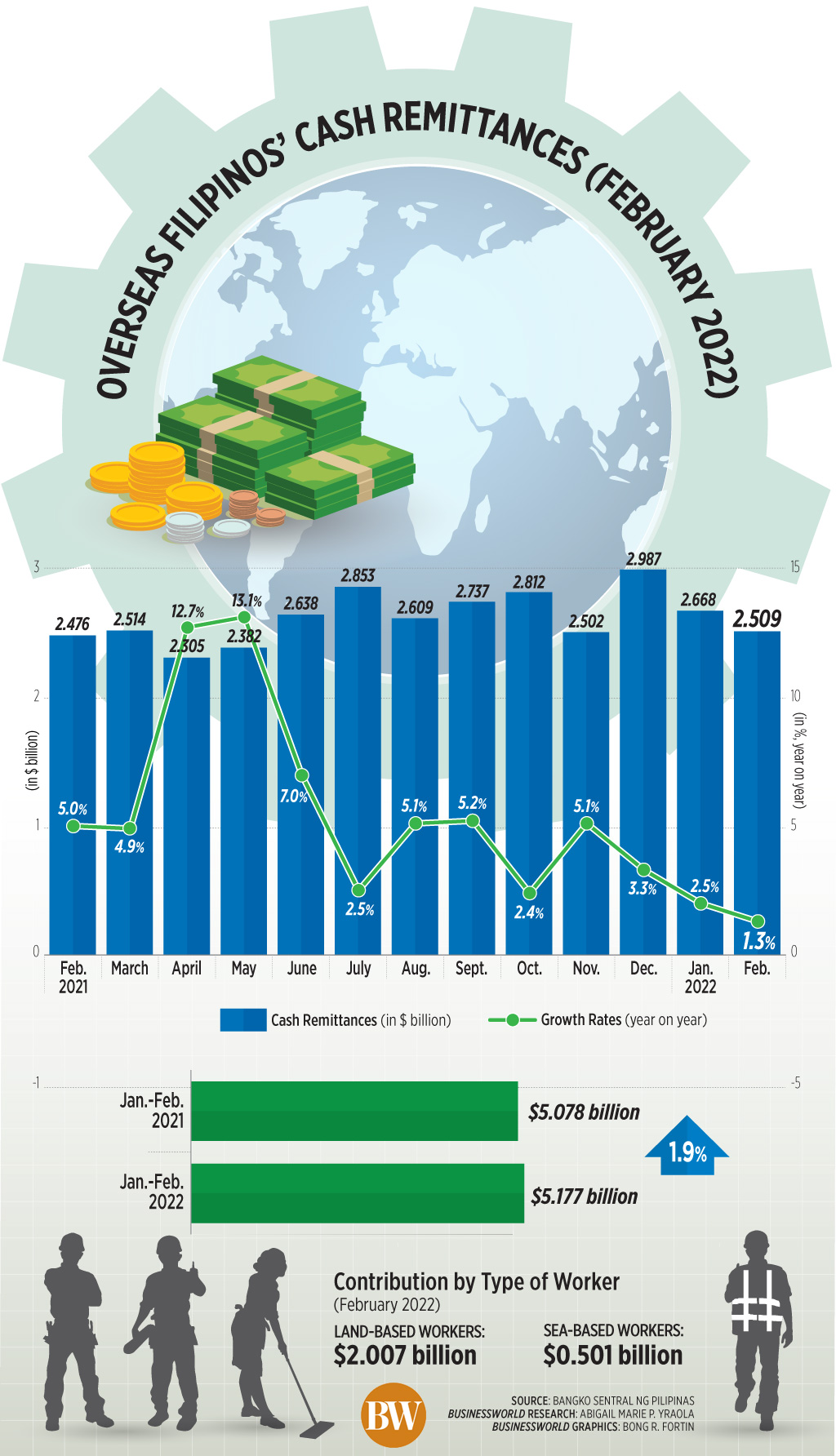

Data from the Bangko Sentral ng Pilipinas (BSP) released on Monday showed cash remittances rose 1.3% to $2.509 billion in February from $2.476 billion a year earlier.

This is the smallest monthly inflow in three months or since the $2.502 billion haul in November.

This is the smallest monthly inflow in three months or since the $2.502 billion haul in November.

February remittance growth was the slowest since the 1.7% fall seen in January 2021.

“The growth in personal remittances in February 2022 was slower, however, compared to that in January at 2.5% due in part to the reimposition of restrictions in OF (overseas Filipino) host countries and the Philippines amid a resurgence in COVID cases across the globe,” the BSP said.

In February, remittances sent by land-based workers went up 1.2% to $2.007 billion, while those sent by sea-based workers rose 1.6% to $501 million.

“(February remittance data) has yet to capture any impact from the Ukraine invasion which may impact remittances from Europe and those host countries near Ukraine and Russia,” UnionBank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said.

Russia began its invasion of Ukraine on Feb. 24.

However, Mr. Asuncion said the protracted Russia-Ukraine war may be a drag on remittance growth, especially for OFWs in some European countries.

The central bank has said that both Russia and Ukraine have minimal contribution to total remittance inflows. However, it warned that a war that would involve Europe and Western countries like the United States, that are major remittance sources, could mean a bigger impact for inflows.

ING Bank-NV Manila Senior Economist Nicholas Antonio T. Mapa said the slower remittance growth in February was also likely due to the depreciation of the peso versus the greenback.

“A weaker peso allows OFWs to send home a smaller amount of dollars to cover peso expenses. In an environment of a weakening local currency and (largely) fixed peso expenditures, there will be less pressure on OFWs to send home more remittances in dollar terms,” Mr. Mapa said.

“For example, now that peso is at P52 per dollar, if an OFW has to send home enough dollars to pay for a P50,000-tuition, he needs to send less in dollar terms to pay the tuition ($961). Unlike last year, when peso was at P48, the OFW has to send $1,042,” he added.

With the peso’s continued depreciation against the US dollar, Mr. Mapa said it is unlikely that remittance inflows will offset the widening trade gap.

Money sent home by Filipino migrants in the first two months of 2022 amounted to $5.177 billion, up 1.9% from the $5.078 billion in the same period of 2021.

The expansion in cash remittances during the January to February period was driven mainly by inflows from the United States, Japan, and Singapore.

For the January to February period, the US, Singapore, Saudi Arabia, Japan, the UK, the United Arab Emirates, Canada, Taiwan, Qatar, and Malaysia were the 10 biggest sources of remittances. These countries accounted for 79.6% of the inflows.

Meanwhile, personal remittances, which include inflows in kind, inched up 1.2% to $2.793 billion in February. This brought personal remittances 1.9% higher to $5.759 billion in the first two months of 2022.

UnionBank’s Mr. Asuncion said OFWs will likely price in higher household spending in the next few months, as the economy continues to reopen.

“It is possible that OFWs are already thinking of the return-to-school costs even as early as now, especially that face-to-face schooling may be restored soon,” Mr. Asuncion said.

The BSP expects remittances to grow by 4% this year. — L.W.T.Noble