September NCR retail price growth slowest in 17 months

RETAIL PRICE GROWTH of general goods in Metro Manila eased to a 17-month low in September, amid the slower annual rise in food costs, the Philippine Statistics Authority (PSA) reported on Wednesday.

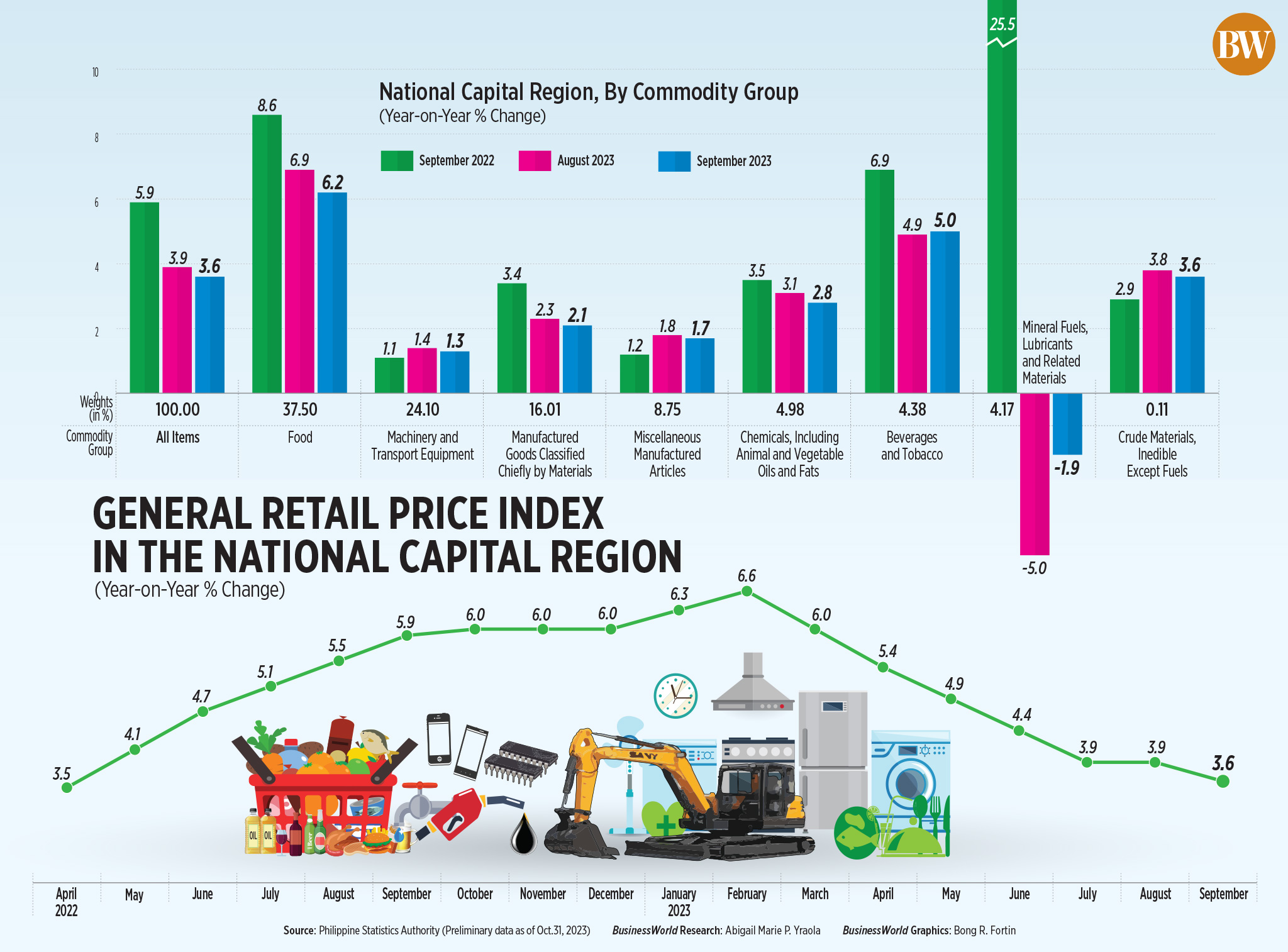

Preliminary data from the PSA showed the general retail price index (GRPI) in the National Capital Region (NCR) slowed to 3.6%, easing from 3.9% in August and 5.9% a year earlier.

This was the slowest since 3.5% seen in April 2022.

Year to date, retail price growth in the capital region averaged 5%, higher than 4% a year ago.

“The primary contributor to the deceleration in the annual increase of GRPI in NCR was the slower annual increase recorded in the heavily weighted food index at 6.2% during the month from 6.9% in August 2023,” the PSA said in a statement.

Slower annual increases were seen in the indices for chemicals, including animal and vegetable oils and fats (2.8% in September from 3.1% in August), crude materials, inedible except fuels (3.6% from 3.8%) and manufactured goods classified chiefly by materials (2.1% from 2.3%).

Also posting lower markups were the commodity groups for machinery and transport equipment (1.3% from 1.4%) and miscellaneous manufactured articles (1.7% from 1.8%).

The PSA said the index for beverages and tobacco rose to 5% in September, slightly faster than 4.9% in the previous month.

On the other hand, the index for mineral fuels, lubricants and related materials declined by 1.9% in September, slowing from the 5% contraction a month earlier.

“The GRPI slowdown may be traced to slower incremental changes in price due to relatively lower markups being imposed,” John Paolo R. Rivera, president and chief economist at Oikonomia Advisory & Research, Inc., said in a Viber message. “However, this may not reflect in a lower inflation as we have seen in previous months when GRPI was slowing down but headline inflation is rising,”

In September, headline inflation quickened to 6.1% from 5.3% in August, but eased from 6.9% in September 2022. Inflation print was the fastest since April’s 6.6% and matched 6.1% in May.

Retailers may also be tempering their markups as they are aware of the lower purchasing power of consumers, he said.

Mr. Rivera said the trend shows that GRPI might continue to decelerate, although this is “still conditioned on supply-side and demand factors especially this holiday season.”

“Prices are usually elevated in the latter part of the year due to increased demand brought about by higher money inflows to consumers, allowing them to increase demand in the midst of supply-side constraints,” he added. — Abigail Marie P. Yraola