October trade gap balloons to $4.17B

By Justine Irish D. Tabile, Reporter

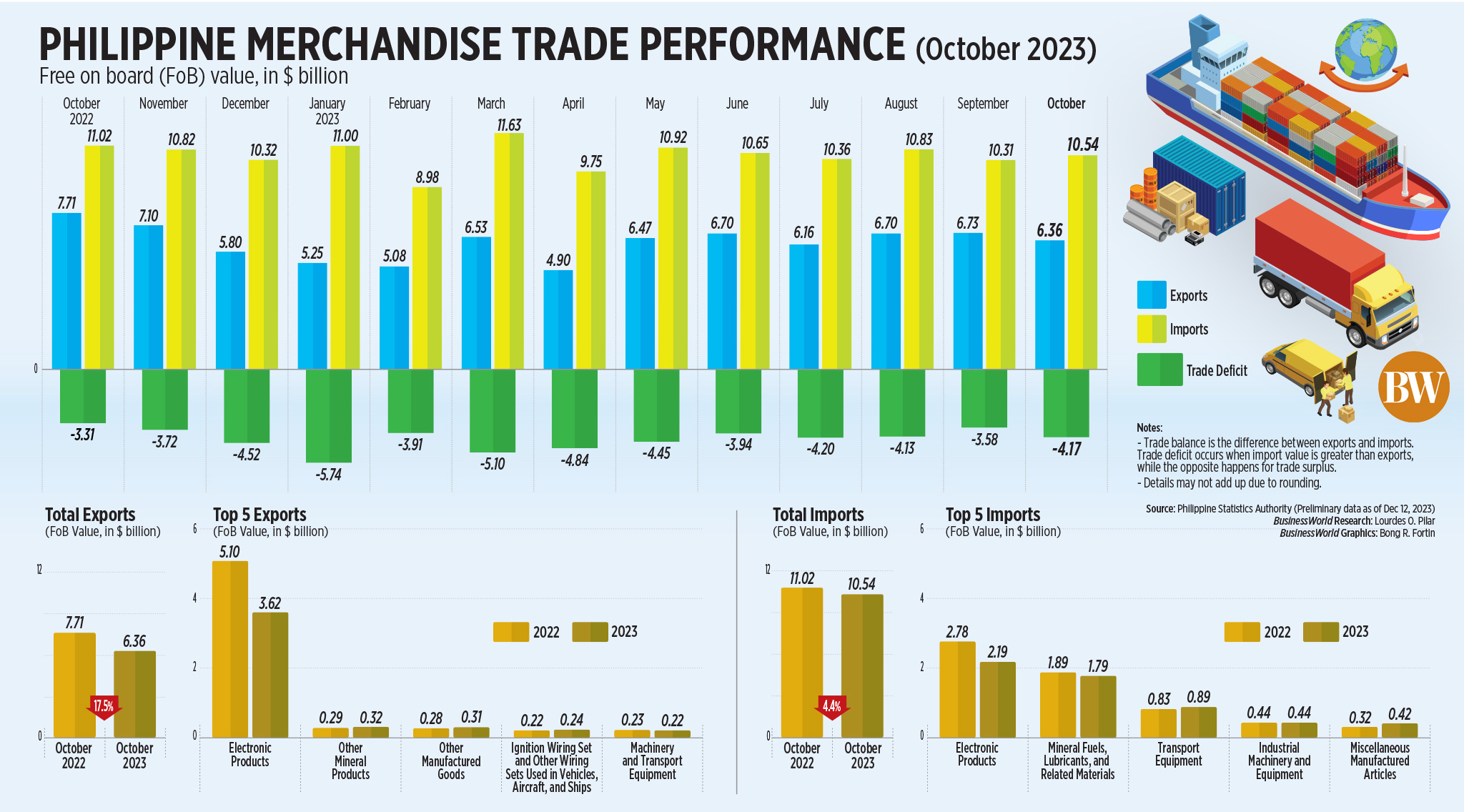

THE Philippines’ trade-in-goods deficit widened to a three-month high of $4.17 billion in October, as exports declined by double digits amid sluggish global demand.

Preliminary data from the Philippine Statistics Authority (PSA) showed the value of merchandise exports fell by 17.5% to $6.36 billion, from the 6.3% drop in September and a reversal of the 20.1% growth a year ago.

The contraction in exports was the steepest since the 20.2% drop in April.

The value of merchandise imports slid by 4.4% to $10.54 billion in October, reversing 7.7% growth in October 2022 but slower than the 14.1% drop in September.

October marked the ninth straight month of decline in imports, but the slowest contraction since the 1.2% in March.

This brought the country’s trade balance — the difference between imports and exports — to a deficit of $4.17 billion in October, widening from the $3.31-billion deficit a year earlier and the $3.58-billion gap in September.

The country’s balance of trade in goods has been in the red for more than eight years or since the $64.95-million surplus in May 2015.

For the first 10 months of the year, the trade gap narrowed by 11.9% to $44.07 billion from a year ago.

This as exports dropped by an annual 7.8% to $60.91 billion, while imports declined 9.6% to $104.97 billion in January to October.

The Development Budget Coordination Committee is assuming 1% and 2% growth for exports and imports, respectively, this year.

PSA data showed manufactured goods, which comprised 81.5% of the country’s total export receipts, declined by 21.1% year on year to $5.19 billion in October.

“The sharp decline in export growth can be attributed to base effects, but we anticipate ongoing challenges from weak global demand,” China Banking Corp. Chief Economist Domini S. Velasquez said in a Viber message.

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said in a Viber message that the steep drop in electronics exports weighed on overall exports.

Electronic products accounted for 56.9% of the total exports in October. However, they slumped by 28.9% to $3.62 billion from $5.1 billion a year ago.

The bulk of electronic exports came from semiconductors, which dropped by 34% to $2.83 billion.

“Imports were also down across the board, with capital and raw materials in the red yet again, suggesting soft capital formation and slower growth momentum,” Mr. Mapa said.

By major type of imported goods, orders of raw materials and intermediate goods slid by 7.5% to $3.82 billion. Import of capital goods fell by 4.6% to $2.86 billion, while consumer goods imports rose by 4.8% to $2.02 billion.

“The consecutive months of sluggish imports are concerning, particularly the lack of recovery in capital goods,” Ms. Velasquez said. “The lone bright spot is the resiliency of demand for consumer goods, but this will hardly be sustainable in spurring the economy towards a higher growth path.”

By commodity group, importation of electronic products — accounting for almost a fifth of total imports — fell by 21% to $2.19 billion in October. Imports of mineral fuels, lubricants and related materials dropped by 5.3% to $1.79 billion.

“Third-quarter gross domestic product (GDP) was boosted by a positive contribution from net exports, but today’s trade data suggest the fourth quarter will see net exports swinging to a negative contribution to growth,” Mr. Mapa said.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message that external trade data mainly reflect the risk of an economic slowdown in the United States, China and other major trading partners.

The US was the top destination of Philippine exports, accounting for 16% or $1.02 billion of total receipts. It was followed by Japan (14.2% or $902.65 million), and China (13.8% or $880.37 million).

China was the main source of imported goods in October at $2.6 billion, followed by Indonesia ($917.53 million), Japan ($834.89 million), South Korea ($785.81 million) and the United States ($711.77 million).

Ms. Velasquez expects slightly better export performance next year amid signs of recovery in global demand in Asian neighbors.

“However, it is essential to take further steps to diversify exports and encourage exporters to jumpstart their businesses,” she said.

Mr. Ricafort said the recent decline in global crude prices and possible interest rate cuts would help support recovery in global investments and trade in 2024.

“The recent decline in global crude oil prices to five-month lows would help reduce the country’s oil import bill and would help narrow the trade deficit,” he said.

Ateneo de Manila University economics professor Leonardo A. Lanzona said the data show the trade sector is “at a standstill.”

“This again is a result of the absence of industrial policy. With high interest rates, the value of Philippine peso should have encouraged more imports. However, an overvalued peso could deter exports as well,” he said via e-mail.

“An industrial policy aimed at promoting products with comparative advantage or at creating new products could have broken this impasse.”